Investment Philosophy

It is the firm’s strong belief that it is not necessary to sacrifice returns while investing according to the Catholic faith. Moreover, CBIS believes the competitive performance we seek to deliver will emerge from the firm’s ability to identify skilled investment managers and combine them in a fashion that improves the overall risk/return characteristics of an investment portfolio.

Multi-manager Structure

In an effort to best deliver a broadly diversified and disciplined set of investing solutions for Catholic investors, CBIS employs a “manager of managers” approach to portfolio development and management. Through extensive research and analysis, the firm seeks to hire the industry’s premier asset managers to sub-advise its portfolios.

The CBIS Investment Team conducts a thorough evaluation of managers before they are hired as sub-advisors. Once selected, CBIS sub-advisors are carefully monitored to ensure they are implementing their strategies while aiding CBIS with our active ownership goals and avoiding investment in companies which violate Catholic teaching.

CRI Quarterly Review – Q1 2025

Read the conversation with Co-Chief Investment Officers Thomas Digenan, CFA, CPA, and John W. Geissinger, CFA.

CRI Quarter Podcast – Q1 2025

Tune in to our quarterly conversation between CBIS’ Co-CIOs John W. Geissinger, CFA and Thomas Digenan, CFA, CPA.

Investment Process

By combining sub-advisors with unique and complementary styles, the CBIS Investment Team seeks to construct and manage funds that provide superior risk-adjusted returns in their style category while incorporating the CRI strategy as an overlay to the investment process. CBIS sub-advisors are carefully analyzed to ensure they can implement their strategies while incorporating Catholic screens.

Through a robust, repeatable construction process, each CBIS Portfolio is built to include:

- Long-term Outlook

- High Conviction

- Correlations

- All Market Environments Drivers

- Investment Style

- ITop-down/Bottom-up

- Interest rate/Sector strategy

- No Specific Return Driver Bias

- Complementary/Low

- Multiple return

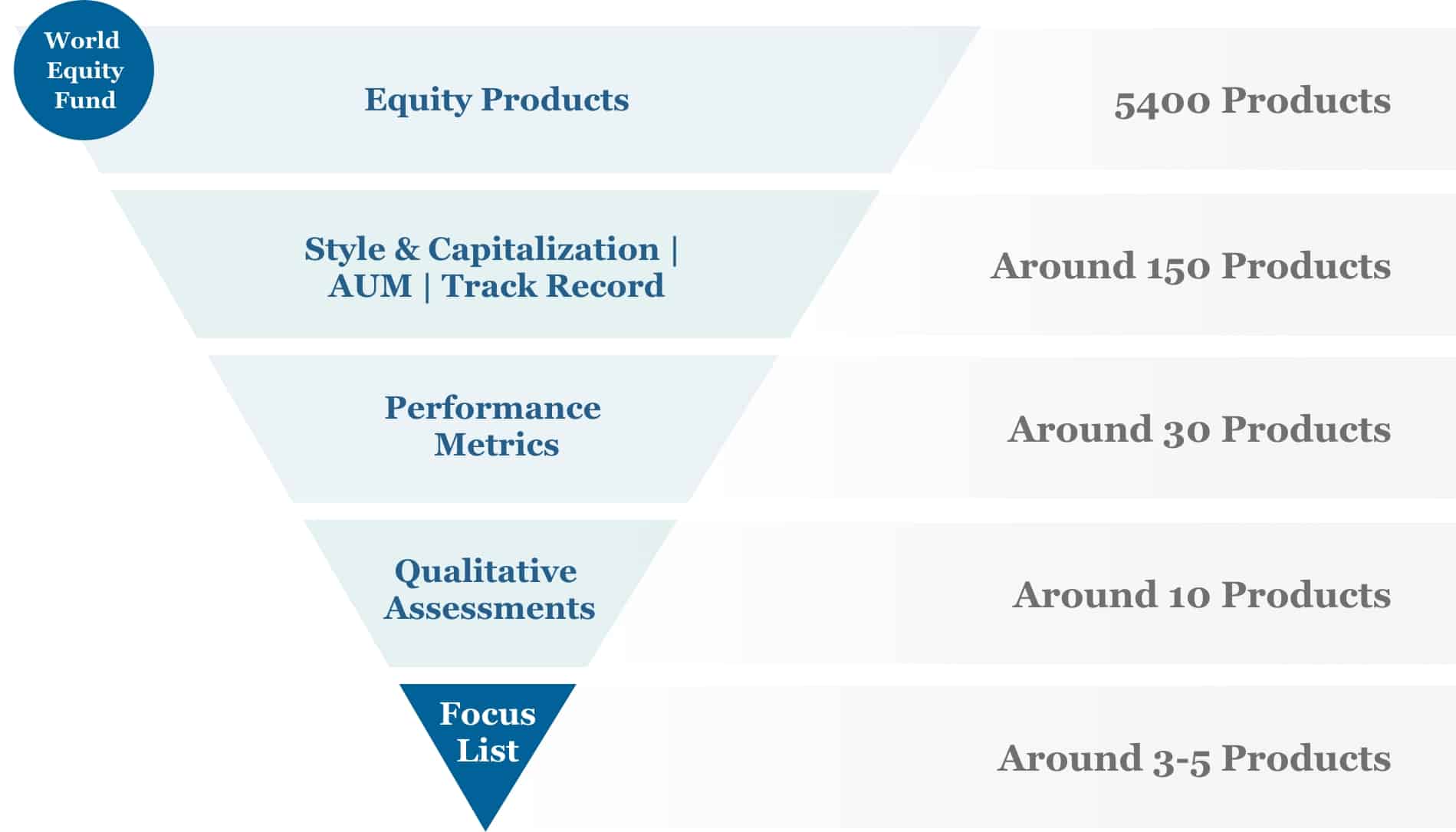

Manager Selection Process

There’s No “C” in “ESG”

There’s No “C” in “ESG”

How is Catholic Responsible Investing different than Environmental, Social, and Governance (ESG) investing?